Get The Parts You Need

Trick Out Your Ride With

Flexible Payment Options

Learn how you can utilize several companies that have partnered with Black Patch Performance to get the parts you need broken down into easy to manage payments. Our full catalog of parts and accessories for you car, truck, or SUV can be bought with one or more of our partner companies. Click below to either learn more or get started today!

How it Works

Fast and Easy Approval:

No credit needed! Get pre-qualified for a lease-to-own plan in minutes and see if you qualify. You just need your basic information

Trick Out Your Truck:

Browse our extensive selection of aftermarket automotive parts. Find the perfect parts to take your truck to the next level.

Flexible Payment Options:

Choose a payment plan that fits your budget and lets you experience the thrill of your upgraded truck sooner.

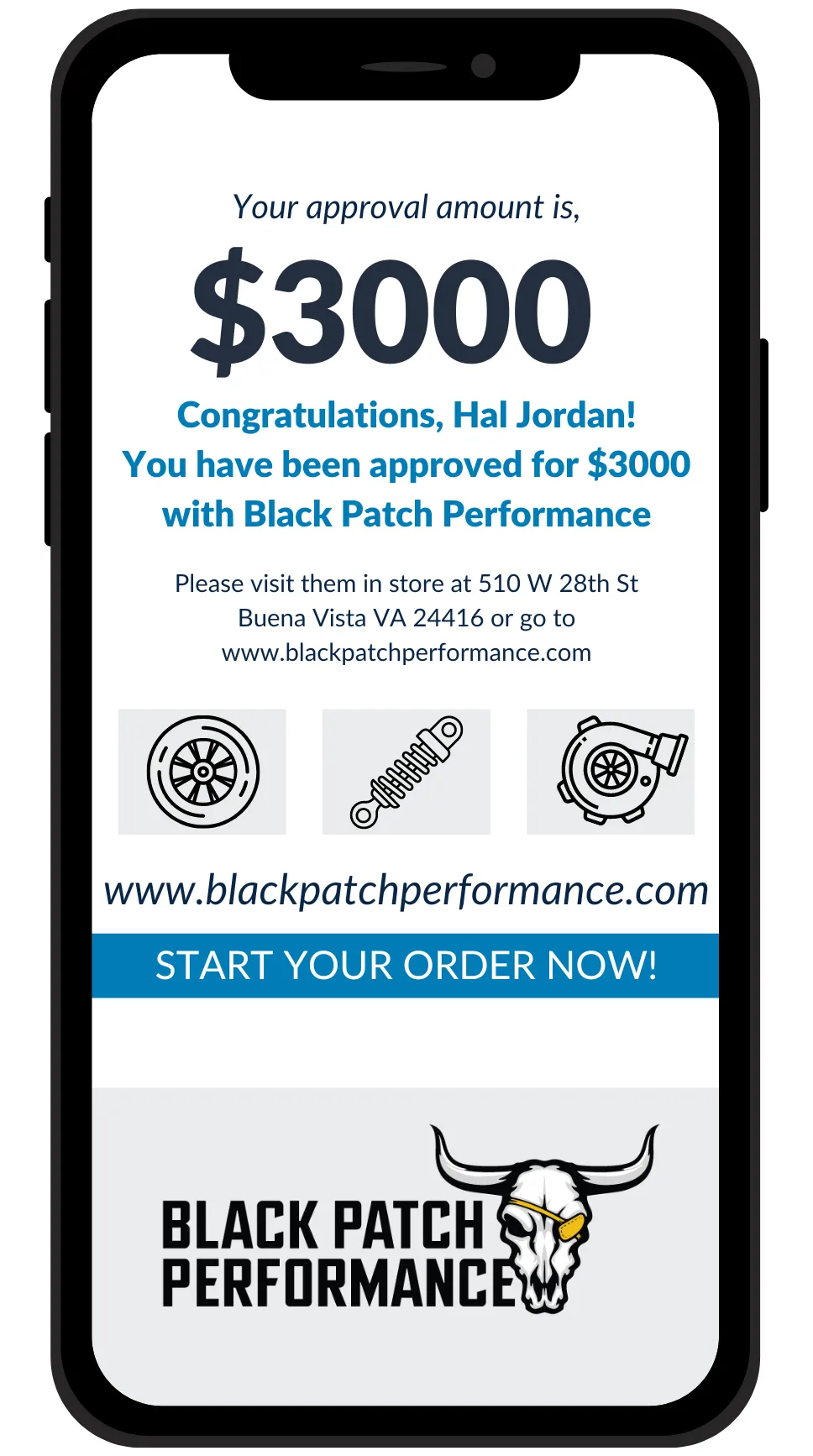

Get approved for up to $5,000

No waiting. No wondering. Get approved in real-time.

The application is fast and easy to complete

You could get approved for $300 to $5,000 of shopping power by meeting basic requirements

Our partners' powerful technology will match you to an approval amount instantly.

While no credit history is required, information is obtained from consumer reporting agencies in connection with an application. Not all applicants are approved.

Get approved for up to $5,000

No waiting. No wondering. Get approved in real-time.

The application is fast and easy to complete

You could get approved for $300 to $5,000 of shopping power by meeting basic requirements

Our partners' powerful technology will match you to an approval amount instantly.

While no credit history is required, information is obtained from consumer reporting agencies in connection with an application. Not all applicants are approved.

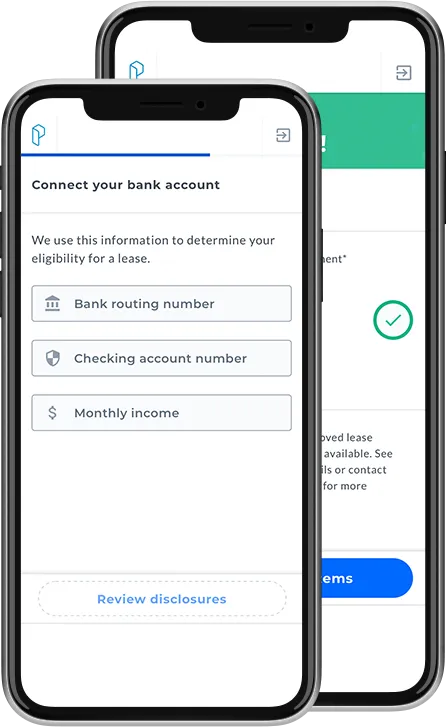

To apply you will need:

Social security number

Bank account details

Credit or debit card

To be 18 years or older

Partner application process is tailored for those with less-than-perfect credit, meaning their decision to approve you for a lease is based on more than simply your credit score.

Why Choose Payment Plans

Upgrade Now, Drive Now

Don't wait to experience the enhanced performance and head-turning style of your upgraded truck. Payment plans make it possible to enjoy your dream parts sooner rather than later.

No Credit Needed

We know a three-digit number doesn’t tell your story. That’s why we partner with companies that offer NO CREDIT NEEDED. They look at many other data points including income and banking history and regularly approve people with less than perfect credit or very little credit history.

Flexibility You Deserve

One size doesn't fit all. Choose a payment plan that perfectly aligns with your financial situation, allowing you to customize your truck without compromising your financial comfort.

Second Chance Credit

Past credit issues shouldn't hold you back from transforming your truck. Certain payment plans, like Lease-to-Own, offer pre-qualification with minimal or no credit impact, giving you a path to upgrade without credit check worries.

Automatic Payment Options

Get paid weekly, every other week, or monthly? Easy payment options and automatic withdrawals accommodate your payday schedule.

Own It Over Time

Lease-to-Own isn't just about temporary upgrades. With every payment, you're building equity in your truck. Once the term ends, the parts you love become yours to keep, adding lasting value to your vehicle.

Budget-Friendly Transformations

Upgrading your truck shouldn't be a financial burden. Payment plans break down the cost into manageable monthly payments, making even the most impressive modifications accessible for any budget.

Ownership by rental/lease agreement with partner companies costs more than the retailer’s cash price.

Cancel or purchase early at any time. Not available in some states

Companies obtain information from credit bureaus.

Not all applicants are approved.

Why Choose Payment Plans?

Upgrade Now, Drive Now

Don't wait to experience the enhanced performance and head-turning style of your upgraded truck. Payment plans make it possible to enjoy your dream parts sooner rather than later.

No Credit Needed

We know a three-digit number doesn’t tell your story. That’s why we partner with companies that offer NO CREDIT NEEDED. They look at many other data points including income and banking history and regularly approve people with less than perfect credit or very little credit history.Flexibility You Deserve

One size doesn't fit all. Choose a payment plan that perfectly aligns with your financial situation, allowing you to customize your truck without compromising your financial comfort.Second Chance Credit

Past credit issues shouldn't hold you back from transforming your truck. Certain payment plans, like Lease-to-Own, offer pre-qualification with minimal or no credit impact, giving you a path to upgrade without credit check worries.

Automatic Payment Options

Get paid weekly, every other week, or monthly? Easy payment options and automatic withdrawals accommodate your payday schedule.

Own It Over Time

Lease-to-Own isn't just about temporary upgrades. With every payment, you're building equity in your truck. Once the term ends, the parts you love become yours to keep, adding lasting value to your vehicle.

Budget-Friendly Transformations

Upgrading your truck shouldn't be a financial burden. Payment plans break down the cost into manageable monthly payments, making even the most impressive modifications accessible for any budget.

Ownership by rental/lease agreement with partner companies costs more than the retailer’s cash price.

Cancel or purchase early at any time. Not available in some states

Companies obtain information from credit bureaus.

Not all applicants are approved.

After you get approved

1. Start Checkout:

Provide your lease info to our sales rep OR the partner company from our online check out

2. Complete Agreement:

Our partner will provide a an agreement of 12 months or longer for you to review and sign.

3. Set Up Payments

Make an initial lease payment and choose a flexible schedule based on how often you get paid.

4. Get your stuff and enjoy!

Once your parts arrive, it's time to unleash your inner mechanic (or find a trusted mechanic) and personalize your truck! Experience the improved performance, functionality, and head-turning style of your upgraded vehicle. Spread the cost of your upgrades with convenient BNPL payments or own them outright after your lease-to-own term ends. Payments with almost all of our partners come out automatically, so all you need to worry about is what the next upgrade will be!

Frequently Asked Question

How long does it take to get approved?

Approvals are almost always instant! So a few seconds after you submit everything you will either get a message letting you know that you are approved or denied.

If you are approved and the amount you were approved for covers the amount you need for the items you're looking out then you don't need to continue applying unless you want to.

If you are denied then just carry on to the next application. The reason we work with multiple companies is so that we can give you the best odds possible for getting approved. Each partner company has different approval criteria so if one company denies you then just go to the next one down the list because the odds are we have at least one, if not more, that will approve you today!

Do I need to know the exact item I want before applying?

NO!

You do not need to provide the item information for the preapproval process, all you need to do is have some basic info available and start the application. The approvals are not like a car loan where you say "I need $10,000 for this car", and then you are either approved or denied for the loan.

How it works is you put in your info and the partner company comes back with an offer showing the maximum amount that they would let you borrow. For some people it is $1000, for some it is $5,000. It depends on your information and your income but besides your general info and your bank info there isn't a need to put in the actual item information during the approval process.

How much is the down payment?

The down payment amount varies between each of the partner companies but it is typically somewhere around $50 down for each approval.

Can I pay extra money down?

Absolutely!

What will my recurring payment be?

Because we do not know what items you will select, we cannot yet tell you your recurring auto-payment amount, 12-month lease-to-own total, payment schedule, etc. These details will be in your agreement, which will be emailed to you after you apply, get approved, and select your items. You’ll have an opportunity to review all of these terms before you sign.

Does it matter that I have bad or no credit?

The decisioning process allows our partner companies to consider more than just credit reports and credit scores. They regularly approve people with less than perfect credit or very little credit history. However, not all applicants are approved.

How long is the agreement?

Standard agreements are set up for 12-month to ownership. However, since we work with several partner companies, this may not be the case for all of them While 12 months is standard, some companies offer 3-month, 6-month, 12-month, 18-month, and 24-month options. There are also other early pay off options that exist. Research each individual partner to get the best idea about their offering

Does the finance company pull credit reports?

Yes. Credit bureau reports are requested for all applicants, but our partner companies look at many data points in these reports besides credit scores. By doing so they can approve many customers with less than perfect credit or with a thin credit file or no credit file.

What is meant by “No Credit Needed”?

“No Credit Needed” means that you don’t necessarily need to have credit history or a strong credit score to be approved for lease-to-own. Our partner companies do check credit bureau reports; however, they look at many other data points to make a final decision, and they regularly approve customers with less than perfect credit or very little credit history.

Our partner companies obtain information from credit bureaus. Not all applicants are approved.

Other Common Questions

What is a lease-to-own purchase program?

The Lease-to-Own Program from one of our partners can be a great way to get what you want right now. Several of our partner companies offer a simple lease-to-own program. If you complete all standard recurring auto-lease payments or exercise an early purchase option, you will own the product(s).

Standard agreement offers 12 months to ownership. 90-100 day and other early purchase options cost more than the cash price. To purchase early or to cancel lease you must call the finance partner your lease is through. Black Patch Performance cannot activate early purchase options.

What do I do after I am approved?

After you are approved:

Pick out the items you want to buy from our website or storefront

Reach out to us to have us set you your invoice OR check out through our website.

Verify address information is correct on agreement

Sign agreement and submit down payment

Let us know you completed your agreement

Receive your items

How long does my approval last?

Your approval is normally valid for 90 days. If you have not signed an agreement within 90 days, your approval expires, and you can reapply. With some partners, if you do not sign your lease-to-own agreement that day, the order is cancelled. However, you can still get a new approval by simply reapplying.

What other information does the partner company consider?

They look at many different data points in our decisioning process. This may include credit information, income, and banking history.

My approval was not for enough money

If your approval amount does not cover the price of the item or items you want, then there are 2 options.

1. Pay the difference outright

2. Stack approvals

Information on stacking approvals:

For your convenience we offer partnerships with several companies in order to make sure you can get approved with one of our partners. As you go through the process of applying for the different companies we are partnered with you may run across something similar to this example.

Finance company A approval for $1000 and Finance company B approval for $1000. Let's say you want a set of wheels that are $1800 for the set. You can utilize both approvals in order to get you those wheels. This essentially means you have $2000 in approvals to use instead of just using one or the other of the two $1000 approvals. The only thing extra is that each finance company requires a roughly $50 down payment for the activation of the finance approval. You will have to pay a down payment for each approval we "stack" in this configuration. To do this for you we just need you to get approved for enough total to cover the items you want and then reach out to us

Keep in mind that due to the nature of the partner companies, this can only work on multiple item orders, essentially we could set up the financing for 2 wheels from company A and 2 wheels from company B. However, if you wanted one expensive single item like a bed cover then this would not be an options because "splitting" an item like that would not be viable.

Why was I declined?

Approval is not guaranteed for every application. Some applications may be approved at certain stores but not others or may already have a loan(s) through the partner company but not be approved for another right now.

Our customer care team can not change the outcome of any application, provide specific details as to why you were declined, or suggest changes in order to get approved. If your application can’t be approved, they will send you an email explaining more about their decision.

EVEN IF YOU WERE DECLINED BY ONE PARTNER YOU CAN STILL BE APPROVED BY ANOTHER

Improving Your Eligibility

If your application was declined you may still be eligible to use Affirm for a different purchase. Each loan application is considered separately, and checking your eligibility doesn’t harm your credit score, so we hope you’ll give us another chance in the future.

Does the partner company report to credit bureaus? Can I build up my credit by doing a successful Lease?

This depends on the individual partner company. You will have to do your own research individually to know for sure

What if I can no longer afford my payments?

Our partner companies understand that unexpected situations come up that may prevent you from continue to make payments on your merchandise. If you find yourself unable to continue with your payment agreement, please feel free to call Customer Service department of the partner company your agreement is through to discuss your options. You have the right to return the items to the partner company your agreement is through (in most cases)

What if I need to change my payments or my payday changes?

Our partner companies are happy to work with you to find a payment schedule that works. If you need to discuss potential changes to your payments, please call the partner company your agreement is through at least three business days before your next scheduled payment.

Is this a hard or soft inquiry (hit) on my credit?

Most of our "No Credit Needed" & Near Prime partners will only make soft inquiries to the big three Credit Bureaus (Transunion, Experian & Equifax). Other secondary bureaus, however, do not offer a soft inquiry option. For more credit based "Prime" financing offers, approvals my require a credit pull.

Not all applicants are approved.

What’s the difference between a hard and soft credit inquiry?

An inquiry occurs any time an individual or business requests a copy of a person’s consumer bureau report – also known as a credit report. The bureaus keep a record of all inquiries made. Creditors and scoring models could consider inquiries a negative factor in a consumer’s report. On a soft inquiry, the inquiry is only visible to the consumer if requesting a copy of their own consumer report, whereas a hard inquiry can be seen by other credit reporting agencies and may impact FICO or other credit scores.

Our Finance Partners

We have partnered with some of the top finance and lease to own companies in the automotive space to give you the best options when it comes to breaking down your parts and accessories purchase into easy to afford payments

Progressive

Progressive Leasing says a three-digit number doesn’t tell your story. That’s why every Progressive Leasing approval is NO CREDIT NEEDED.

*Progressive Leasing obtains information from credit bureaus. Not all applicants are approved.

Katapult

Katapult has lease purchase plans designed just for you — and there’s no credit required. Plus, we keep the experience simple and transparent. It's your path from "maybe" to "all mine."

Snap

Snap offers convenient, hassle-free plans that work with your paydays and budget, including options to lower your overall costs.

American First

Get clear terms, easy payment options, and consideration beyond your credit score with American First Finance.

Kafene

Enjoy the financial flexibility you deserve with Kafene’s affordable lease-to-own options for all of your automotive needs

PayPal

Pay with PayPal Credit, and get 6 months special financing on purchases of $99+. Interest will be charged to your account from the purchase date if not paid in full within the promotional period.

Affirm

Buy now, pay later with flexible plans that fit your budget. Rates as low as 0% APR

Rates from 0–36% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Financing Law license. For licenses and disclosures, see affirm.com/licenses. For example, a $800 purchase could be split into 12 monthly payments of $72.21 at 15% APR

Shop Pay Installments

Shop Pay Installments offers you the option to split your purchase into payments.

Rates from 0%-36% APR. Payment options through Shop Pay Installments, are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required. State notices to consumers https://www.affirm.com/licenses.